By Mia Hunt

Bigger is better for take-up

Last year, the industrial market had one of its best years ever, defying instability caused by the referendum.

Last year was a record year for the logistics market, despite the uncertainty engendered by June’s EU referendum result.

UK-wide activity reached 47.7m sq ft, up 10% on 2015 and 11% higher than the annual average over the past five years.

Moreover, take-up actually improved post-referendum, with H2 2016 accounting for 53% of the total for the year.

“However, the number of deals in 2016 was actually down 10% on 2015, implying that there was decreasing depth to market activity,” says Oliver du Sautoy, head of research at Lambert Smith Hampton (LSH).

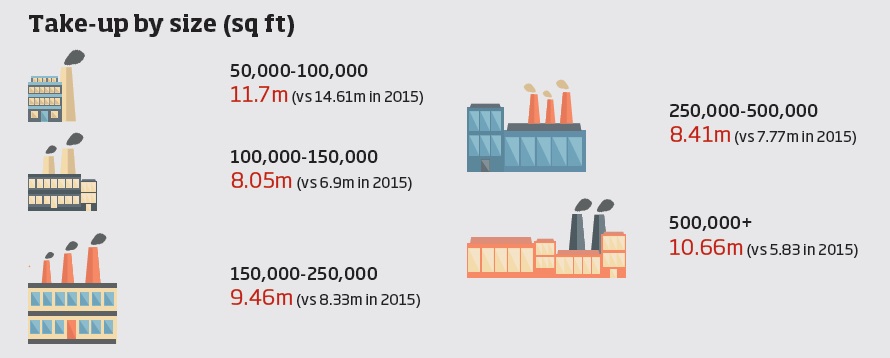

“The year owed its record to particularly strong activity for mega-sheds. Take-up of units of 500,000 sq ft or larger reached 10.7m sq ft, up 83% on 2015 and smashing the previous record from 2010.”

Amazon was fundamental to the total, taking 8.1m sq ft across 23 units of more than 50,000 sq ft, equating to 17% of overall UK take-up. This included its 2.2m sq ft pre-let at London Distribution Park – the largest-ever logistics deal in Europe.

Geographically, all but four UK regions saw 2016 take-up pull ahead of their 2015 totals. Greater London and the South West were particularly strong, while in contrast the North East and the North West were down on 2015.

Despite strong take-up, UK-wide availability crept up 3% from 2015’s all-time low and stood at 72m sq ft at the end of 2016.

“This was largely down to new-build speculative space entering the market, which at 7.2m sq ft, was the highest amount since 2012. That said, this was nowhere near the peak of 25.2m sq ft in 2009,” says du Sautoy. “Meanwhile, the pace of development activity has cooled slightly. At the end of 2016, 5.1m sq ft was under construction on a speculative basis, down from 5.6m sq ft the previous year.”

With supply remaining tight, upward momentum on rents was sustained throughout 2016. Across the 60 markets, 34 witnessed an increase in prime headline rents, equating to UK-wide average growth of 4.4%. Manchester was the top performer, recording a 23% increase, with headline rents now standing at £6.75/sq ft.

“Notably, average growth in secondary rents in 2016 were closely in line with prime, having outperformed prime during the previous three years,” adds Steve Williams, national head of industrial and logistics at LSH.

“The result indicates the arrival of new space in the market is helping to satisfy pent-up demand.”