By Emanuela Barbiroglio

Lower build cost inflation could present opportunities

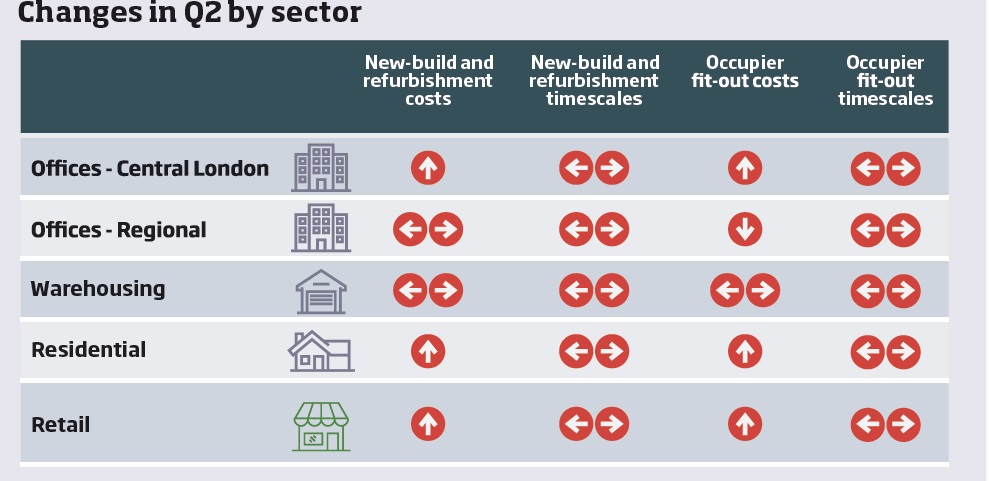

Development costs in some sectors of the commercial property market are starting to plateau, according to the latest edition of Savills’ Programme and Cost Sentiment Survey (SPECS).

The survey, which distills 48 indicators of development costs and project timescales into a positive or negative score, has consistently recorded a positive score over the past year largely as a result of increasing costs.

Furthermore, in parts of the market – notably warehousing and regional offices – costs are flattening and in the case of occupier fit-out costs for regional offices, they are even starting to fall.

“The Simon Collett, head of Savills’ building division, says this may present opportunities. “With a level of stability now appearing to return to some markets, it is interesting to note that some sectors and geographies are starting to see build costs plateau and, in regional office markets, fall,” he says. “While not yet having an impact on timescales, developers or occupiers could look to take advantage of these market conditions.”

Savills’ SPECS report also explores how the development of retail space is changing in response to the evolution of the wider retail market and highlights the growing number of online retailers opening stores, particularly in the fashion industry, as evidence for the continued relevance of physical stores.

The report predicts that the changes in the way retailers are using stores will have the biggest impact on landlords, which will have to deliver superfast broadband to allow for the “digitisation of the in-store experience”, for example, and provide flexibility for innovative fit-outs.

“The retail revolution presents a number of practical realities for the industry,” says Claire Hood, an associate director at Savills: “These include how to deliver innovative retail space, as well as ensuring operational trading requirements are met when combining brands and services under one roof, all of which can lead to higher costs and a longer delivery programme.”