By Emanuela Barbiroglio

Overseas investors maintain interest in regional offices

International money accounted for 45% of all investment in UK regional office markets in 2016 – up from 35% in 2015, reveals Knight Frank’s latest Regional Office Market Report.

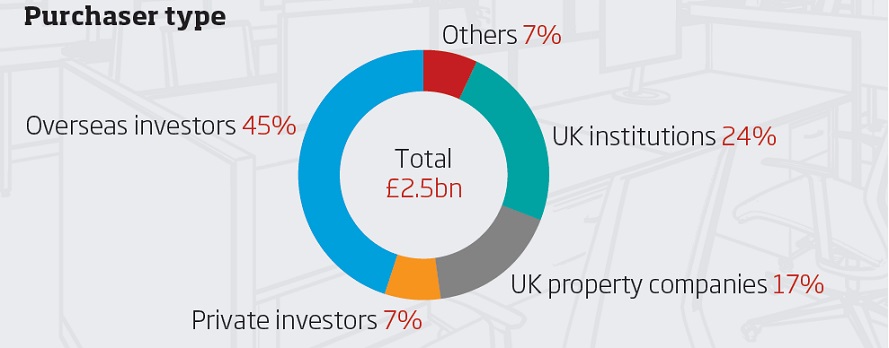

While total investment volumes across the 10 cities tracked in the report fell from £3.2bn in 2015 to £2.5bn in 2016, investment remained above the long-term average of £2.15bn and overseas investment remained consistent with the previous year, at £1.1bn overall.

“Regional UK offices remain an attractive property investment offer for overseas investors attracted by the weak pound, the sophisticated property market and relative political stability,” says Alastair Graham-Campbell, head of the regions at Knight Frank. “Not only are yields in excess of those in London and the South East, but investors are benefiting from a substantial return on their equity from seeking prudent bank lending at competitive rates.”

Edinburgh in particular surpassed expectations with investment hitting £445m, its highest annual level in 10 years. Significantly, overseas investment represented 70% of this total, with German buyers the most active.

The continued strength of the leasing market has supported investor interest in regional offices, according to Knight Frank, which noted that while the overall take-up of 5.9m sq ft was slightly down on 2015, it was well above the long-term average.

Bristol saw the highest year-on-year growth at 60% with take-up reaching 783,000 sq ft. Take-up in Manchester reached 1.3m sq ft for the third successive year as the law firm Freshfields Bruckhaus Deringer signed the largest inward deal on record for the city at 81,000 sq ft.

Knight Frank attributes the influx of foreign cash not only to a weaker pound but also to the new opportunities regional locations offer in terms of development and refurbishment of office spaces. It adds that international buyers still see potential for significant value growth in the regions.

Graham-Campbell also credits increased political will to empower regional cities. “The built environment is a fundamental component of [the government’s] change agenda, one that is creating the right conditions for innovation and growth,” he says.