By Emanuela Barbiroglio

Shopper confidence picks up despite rising inflation fears

Consumer confidence has improved since the start of the year despite fears that rising inflation would put increased pressure on household finances.

According to CACI’s latest research, which is based on British Population Survey data, shopper confidence dropped slightly between the EU referendum last summer and Christmas, but has picked up since.

The research assesses the net difference between those who think they will be better or worse off in three months’ time and expresses this as a positive or negative percentage. It reveals that confidence levels stood at 12% in March, up from 8.7% in December. Beyond the headline trend, CACI found that confidence was particularly high among less affluent consumer groups.

“The comfortable communities, financially stretched and urban adversity [group] all have confidence levels higher than at the close of 2016,” says Paul Langston, consulting partner at CACI. “Particularly the less affluent and lower-spending groups, who tend to have a more short-term focus, are now showing higher levels of confidence than in April 2016.”

The improvement in confidence follows warnings that retail sales could come under pressure in the next few months. Helen Dickinson, chief executive of the British Retail Consortium, warned last month that “with a cocktail of rising costs and slowing wage growth as the backdrop, conditions for consumers will get tougher”.

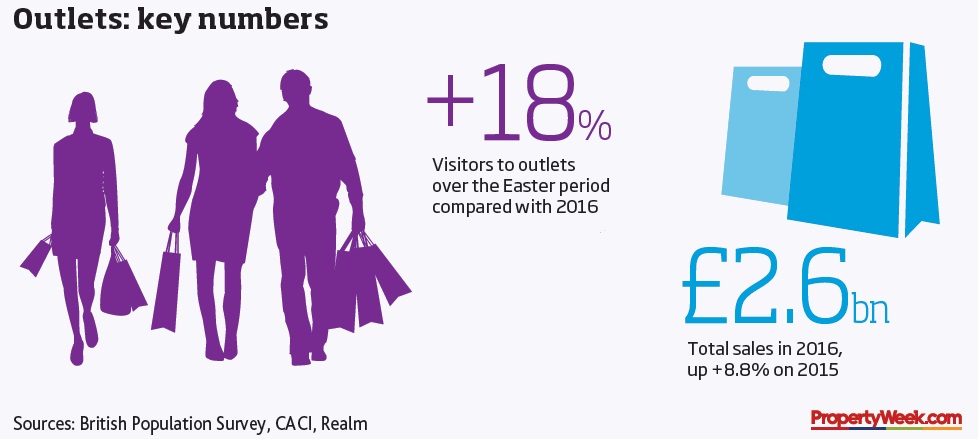

However, some parts of the retail market appear better placed to weather potential storms than others. The outlet sector has shown particularly strong growth of late. Sales totalled £2.6bn in 2016, an increase of 8.8% on 2015, and 2017 looks set to be another good year for the sector, according to retail outlet operator Realm. It reports that sales at its schemes in the weeks surrounding Easter Sunday were up 19% on the same period last year, while footfall was up 18%.

“We have seen an increase in footfall across the board, in spite of consumers’ more prudent spending habits, and importantly this has been converted to spend at each scheme,” says Colin Brooks, managing director of Realm.