Prime London residential prices will close 9% down this year, Savills has predicted, because of the uncertainty around Brexit and changes to stamp duty.

Stamp duty reforms over the past two years, including the 3% surcharge on second home purchases introduced in April, have hit the prime London market the hardest, it said.

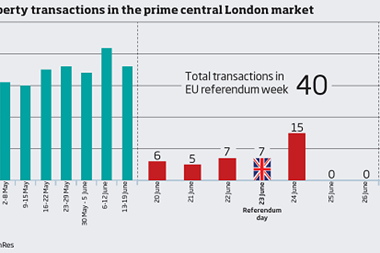

In the run-up to the EU referendum, prime London prices were 8.1% below their 2014 peak, falling more than 2% in the first six months of the year.

Buyers want to wait until the Brexit negotiations are over before entering the market, and only a drop of around 6-7% will tempt them to pull the trigger, Savills said.

The agent predicted that the downward trend would continue until the end of the year, with prices falling 9%in total in 2016, before stabilising over the next two years.

“Return to growth” soon

Lucian Cook, Savills UK head of residential research, said the market would soon rebound from a slow summer.

“We know the prime London markets have generally rebounded strongly after a period of adjustment.

“While the tax backdrop will continue to be factored into buying decisions, no other European city has the infrastructure to match London as world city and global financial centre and this should underpin a return to trend levels of growth,” he said.

No comments yet