I recently attended our inaugural UK Logistics Conference in London along with stakeholders from across the sector.

In addition to current topics - economic factors, infrastructure, labour - one of the more prescient discussions focused on the role and impact of disruptive technologies.

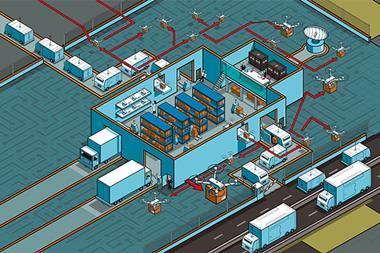

We discussed how advances in energy storage will revolutionise the deployment of renewables; how blockchain will be used to record the transfer of assets safely and securely; and how the ‘Internet of Things’ will facilitate data collection, which when combined with powerful analytics could help property managers detect, and even predict, problems with their buildings.

If this seems fanciful, the reality is that our sector is already experiencing exponential change due to technologies once regarded as disruptive but that are now mainstream.

Thanks to high-speed internet, ecommerce dominates retail headlines and is having a positive impact on logistics real estate.

Ecommerce growth cycle

Globally, ecommerce currently accounts for about 20% of total new leasing, up from less than 5% five years ago.

So where are we in the ecommerce growth cycle? What will the impact be on leases and developments? And how do new e-fulfilment requirements change the shape and functionality of buildings?

Our global research team has conducted a deep analysis of the industry’s growth. Despite the fourfold increase in the percentage of lettings to ecommerce companies, it found that we were still in the very early days of its evolution.

Online shopping may date back two decades and e-fulfilment may have had a more visible share of the logistics industry for at least five years, but supply chains are only now starting to modernise to keep up with dramatic volume growth.

There were some interesting findings in relation to customer operations as well. Online retailers need about 1.2m sq ft/€1bn (£890m) of online sales on average, which is roughly three times the distribution centre space required for traditional bricks-and-mortar retailers.

Our research identified four unique characteristics of online order fulfilment: extensive product variety, higher inventory, larger outbound shipping space requirements and increased reverse logistics.

As e-fulfilment models evolve, so too do the go-to market strategies for retailers’ online offerings. Recently, bricks-and-mortar retailers have expanded investments to execute click & collect and ship from store.

It remains to be seen if these strategies will endure given the challenges yet to be overcome, among them inventory tracking, unit economics and the scalability of these solutions.

One thing, though, is clear: the need to be able to deliver what the consumer wants when they want it across multiple channels has forced retailers to ask more of their supply chains.

Flexibility is key

Ecommerce is an increasingly important demand driver for logistics real estate. The recovery of occupancies and market rents has occurred faster and in greater magnitude due in part to the scope of ecommerce demand.

However, ecommerce growth comes at a time when there is a space shortage in Europe. Logistics occupiers have been growing incrementally and in turn have run out of space.

They are demanding smaller units, which are available immediately, in buildings that can be divided up into units. They want the flexibility to accommodate different types of goods and they ask for shorter leases.

Thanks to the size of our portfolio in Europe, we have many smaller buildings and also larger properties that can be offered in units. The ability to meet demand for space while leveraging innovative technologies is the next big challenge for logistics real estate.

Ben Bannatyne is president of Prologis Europe

No comments yet