We knew bonuses in the agency world were likely to be down this year in the wake of the EU referendum, which is why earlier this month we investigated the connection between the anticipated slump and recent flurry of high-level people moves in our feature, Agents of Change.

But only now has the hard evidence emerged showing how significantly they have fallen.

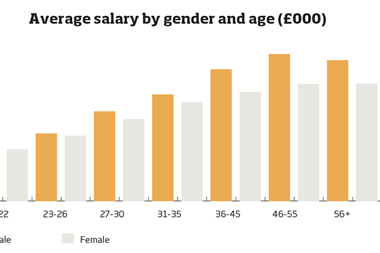

This year’s Salary Survey, shared exclusively with us by RICS and Macdonald & Company, reveals that bonuses have tumbled a wallet-whittling 14.4%, while salaries are down 4.5%.

So no fancy holidays or new cars this year, folks: you’ll have to slum it like the rest of us (feel free to contact me if you need advice on how a secondhand Mondeo handles) or, as many people recently have, move to pastures new.

There are a couple of caveats. The fall in salary partly reflects the fact more junior employees responded to the survey this year and fewer senior people, skewing the results towards the lower paid. Plus two thirds of respondents have actually seen their salaries increase.

Read the full survey results and analysis here

There is nothing, however, to mitigate the bonus blow. The combination of a first half of 2016 in which certain parts of the market had undoubtedly passed their peak and a second half in which many experienced the Brexit blues conspired to ensure transactional activity headed in only one direction, with inevitable consequences for people’s pay packets. As one senior agency figure puts it bluntly: “If volumes are down, fees are down and bonuses are down.”

Worse, the figure probably understates the decline in the agency world, he suggests, with some firms compounding matters by offering “crazy salaries” in recent years in the race for talent.

There is a disconnect between financial performance and earnings - Simon Prichard, Gerald Eve

Gerald Eve’s Simon Prichard is equally unsurprised by the findings.

“Most firms are coming off an exceptional performance calendar year-end 2015,” he notes.

“The uncertainty of 2016 impacted performance and there is a disconnect between financial performance and earnings.”

Pockets of resistance

Interestingly, however, there are pockets of resistance, with those in the industrial sector, notably, remaining positive about the future. Firms will have to take into account that some parts of their business are doing better than others, says Prichard.

“They will need to be more selective on reward patterns to reflect market realities - keeping all of the people happy all of the time is going to be increasingly difficult!”

In the meantime, most in the industry are resigned to their pay and benefits either staying the same or being negatively affected over the next year. Indeed, the word that comes up repeatedly when I ask how they feel about the market is “nervous”. You should be.

As Property Week columnist Steve Norris tweeted earlier this week: “Forget Brexit. Biggest challenge to UK financial services & other exports will come from US. Relaxed float regs and trashed WTO/GATT rules!”

Forget Brexit. Biggest challenge to UK financial services & other exports will come from US. Relaxed float regs and trashed WTO/GATT rules ! https://t.co/fNwe2epk4D

— Steve Norris (@StevenJNorris) February 13, 2017

He reasons that President Trump has already said he wants to roll back regulation and attract US businesses back home and adds: “We used to say there were more US banks in London than New York. How long will that last in this new Trump age? And what would that do to commercial property in London?”

What indeed?

No comments yet