Could the Chinese government’s crackdown on overseas investment have a more serious impact on the UK property market than expected?

Back in January, shortly after the Chinese government introduced measures to limit capital outflows in a bid to protect the value of China’s currency, nobody was forecasting a major slowdown in investment in the UK, not when Chinese investors had pulled off some of the biggest deals in the City office market in the second half of 2016.

The Cheesegrater and Walkie-Talkie deals (by CC Land and LKK Health Products Group respectively) this year have only lulled us all further into a sense of security - but is it a false one?

The fact that Chinese investors are now not so much pulling off deals as out of them suggests it could be. On the face of it, perhaps we shouldn’t read too much into the news that Dalian Wanda has abandoned its £470m purchase of Nine Elms Square. After all, two other Chinese investors, R&F Properties and CC Land, have stepped into the breach.

Maybe the Chinese government has a particular problem with Wanda and will look more benignly upon other investors, especially if they have yet to build a substantial presence in a market, as is the case with R&F in the UK.

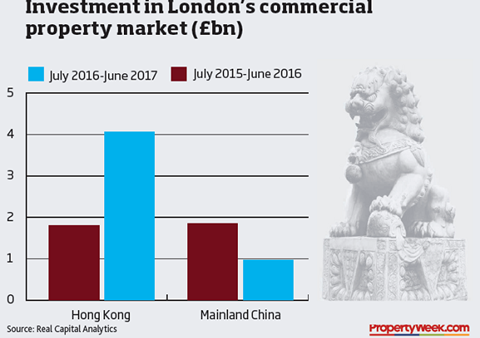

There is also a school of thought that the balance of power will simply shift from mainland China to Hong Kong. That certainly seems to be substantiated by the latest figures from Real Capital Analytics, which show Hong Kong investment in the London property market grew sharply in the year to June while investment from mainland China fell significantly.

However, for every bull who argues that future investment will merely be sense-checked to curb deals deemed to be “against peaceful development, win-win co-operation and China’s macro controls”, as China’s State Council put it, there is a bear like Jefferies’ Mike Prew who regards Hong Kong as little more than a channel for mainland Chinese money and warns that the tap has now been “closed off”.

People should not just be worried about levels of investment from China. Although there still appears to be plenty of appetite for the UK from the wider global investment community, not least the Middle East and Asia, yields are so tight in the prime London office market that some agents would argue that there is little value to be had right now.

In short, it is not only the great wall of money from China that could crumble over the coming months. We could be due a much more substantial correction, in the prime London office market in particular.

RESI Twitter debate

On a brighter note, I am delighted to report that last Thursday’s #RESIdebate on Twitter, hosted jointly by Property Week and Savills, was a resounding success, generating some 1.7 million impressions.

It’s not often that industry heavyweights are restricted to having their say in 140 characters or fewer. Fortunately, they will be able to debate the issues raised more fully at next month’s RESI Conference. Tickets are going fast so don’t miss out.

No comments yet