What links Blackstone, Mrs Brown’s Boys, Lewis Hamilton and the Queen? You guessed it: the Paradise Papers.

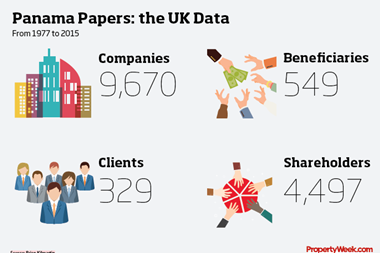

This week’s leak of a huge batch of documents from law firm Appleby has brought tax avoidance back into the spotlight 18 months on from the Panama Papers.

The Panama Papers were bigger in size but the Paradise Papers are arguably more significant as they expose the tax affairs of some of the world’s largest and most respected companies and institutions. In the world of real estate, US private equity firm Blackstone has come under fire for its use of offshore trusts to cut its tax bill in relation to two major property deals in the UK and Grosvenor Group’s historic use of offshore vehicles has also been exposed.

Amid the moral outrage that all this is provoking, there’s a danger of tarring everyone with the same brush. It is one thing for an investor to put money in an offshore fund because it is the best fund in its sector and then pay UK tax on any profits. It is quite another to go to extreme lengths to avoid paying tax by using a complex web of offshore companies and financial wizardry.

One of the first stories to break this week was that the Duchy of Lancaster, which provides the Queen with an income, had invested about £10m of its £500m estate in funds registered in the Cayman Islands and Bermuda.

The reaction to the news shows just how careful bodies such as the Duchy of Lancaster, and others expected to have the highest moral standards like the Church Commissioners, have to be to avoid reputational damage. However, in no way should it be lumped together with the hardcore tax avoidance practices of some businesses and individuals.

In real estate, one wheeze used by some investors has been to fund deals using inter-company loans with exorbitantly high interest rates. Profit from the rental income on a property is written off against the interest charges so that no tax is paid and the mother company in some tax haven or other is paid a nice double-digit interest rate on the loan, which just so happens to be in line with the investor’s target return.

Crackdown

It is quite right that the UK government should be trying to crack down on this particular practice with measures to restrict the tax deductibility of interest, which are expected to get royal assent later this month.

It is just a pity that the government has to resort to this. Inevitably, tougher regulation will have unintended consequences that punish the innocent as well as the guilty. There is also a danger that if the UK leads and other countries don’t follow, our economy would suffer. However, regulation is a necessary evil. Big companies cannot go on complying with the letter of the law while violating the spirit of the law. It erodes public trust in business and is bad for everyone in the long run.

So what can we expect to happen? Little more than a month after the Panama Papers, the UK government announced that foreign companies buying UK property would have to join a new public register of beneficial ownership. Theresa May will be under pressure to take more action after this leak - it would certainly be a much-needed vote winner. Let’s just hope that any new measures are well thought out and that the government doesn’t lump everyone with a link to a tax haven in the same boat.

No comments yet