Since the outcome of last June’s EU referendum there has been ongoing uncertainty over its impact on the UK real estate market.

The government’s immediate concern is when to trigger Article 50. Until this happens, there is no certainty that the UK will in fact exit the EU.

Even before that, we await the Supreme Court’s judgment on whether parliamentary approval must be sought before the government gives notice pursuant to Article 50. If the court finds against the government, the UK could find itself in a constitutional crisis.

Property law, being domestic in nature, will be largely unscathed by the decision to leave the EU. So the key impact will be commercial rather than legal. The fact that the post-EU landscape has yet to be mapped out has caused market uncertainty. This has filtered into legal documents and will continue to do so as, for example, tenants seek shorter leases, more incentives and more frequent break rights to future-proof their occupational arrangements.

Uncertainty is not, however, confined to Brexit or to the UK. The US awaits a Donald Trump presidency; the Italian prime minister resigned after losing a referendum on constitutional reform; and there are the German and French elections coming up in 2017. Against this backdrop of the unexpected becoming the new norm, Brexit may not look so radical after all.

There remain plenty of good reasons to invest in the UK. The UK’s location, language, culture and legal system are all draws. There is also the bonus of discounts for foreign investors trading in currencies that have risen against the pound. In contrast, those already operating out of the UK must balance any perceived benefit of moving elsewhere against the time, cost and hassle of relocating.

No new trends

Some have pointed to difficulties at the top end of the residential market as evidence that Brexit has tarnished UK property. But changes to the tax system and a degree of oversupply were already testing that part of the sector in early 2016.

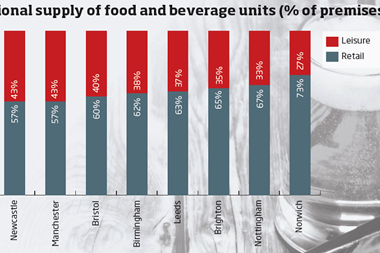

Equally, the difficulties on the high street predated the referendum as retailers faced up to the challenge of omni-channel shopping and changing consumer preferences. It is arguable, therefore, that Brexit has not created any new trends. Rather it has put existing trends into sharper focus.

Hopefully, Brexit will force the government to focus on these long-standing challenges. Encouragingly, the 2016 Autumn Statement emphasised infrastructure, which is one of the keys to stimulating new development. In the meantime, the property world should view Brexit in context - it may be disruptive, but it certainly does not feel like the disaster some had predicted.

Rob Thompson is a partner at Dentons

No comments yet