Although the past year has been a time of political drama across Europe and in the UK, one area that has stayed resolutely stable is the logistics property sector.

Despite turmoil and uncertainty, the market has just shrugged its shoulders and carried on.

Investors continue to target our sector and we are still doing deals. In the first three months of 2017, for example, Prologis signed leases and renewals on nearly 12m sq ft across Europe.

These results build on a successful year in 2016 and there is every indication that this trend will continue. In the UK alone, we are currently on site with more than 2m sq ft of build-to-suit developments, as well as 760,000 sq ft of speculative units, which are already attracting interest.

Retail, particularly ecommerce, continues to have a significant impact on our sector because, no matter what happens on the political scene, consumers continue to shop.

But although consumer demand is rising, it is also constantly changing.

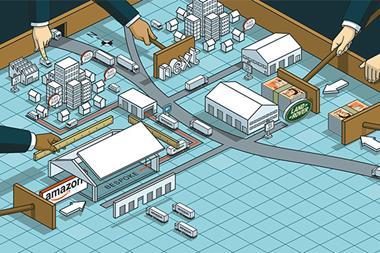

Retailers’ operations are becoming increasingly complex as they concentrate on moving goods through the supply chain with ever-greater speed and efficiency to anticipate consumer demand.

For some occupiers, distribution centres with maximum flexibility are part of the solution to this challenging situation. These buildings have the capacity to hold high inventory levels of many different product lines along with space for automation, reverse logistics and extensive facilities for staff.

The role of rail

Rail freight still has a great deal of untapped potential for the logistics sector. The big supermarkets are already using rail extensively to transport ambient products and general merchandise. We believe it could also play a pivotal role in ecommerce.

Ecommerce operators are under constant pressure to meet faster delivery times. But in densely populated urban areas, last-mile delivery can present problems. Fleets of delivery vans add to traffic congestion and air pollution, while the declining availability of industrial land means there is a shortage of distribution space.

Some retailers and distributors are using rail to work around these difficulties. They assemble deliveries at logistics centres close to intermodal terminals, then use trains to carry consumer products and perishable items into city centre stations. Effectively, the train becomes a moving consolidation centre that allows operators to transport goods in a way that is cost-efficient, faster and more sustainable than by road.

On a global level, the launch of China’s $900bn Belt and Road Initiative with its new overland rail network service between China and Europe has turned the spotlight on rail freight. Rail is more cost-effective than air cargo and twice as fast as the 40- to 45-day journey by sea.

With China’s consumer economy projected to expand to $6.5trn by 2020, the potential offered by Belt and Road is enormous. Freight can be transported from rail-connected logistics centres directly to new, high-quality facilities in China for onward distribution.

As President Xi has explained, Belt and Road is a modern version of the ancient Silk Road that once stretched from Xi’an to Rome. Although the route is more than 2,000 years old, it opens fresh opportunities for everyone involved in the logistics property sector.

No comments yet